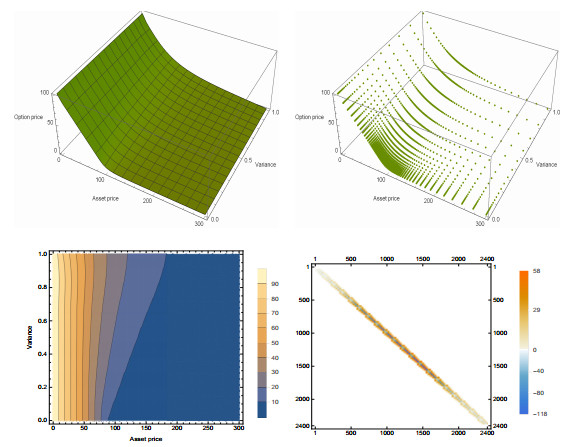

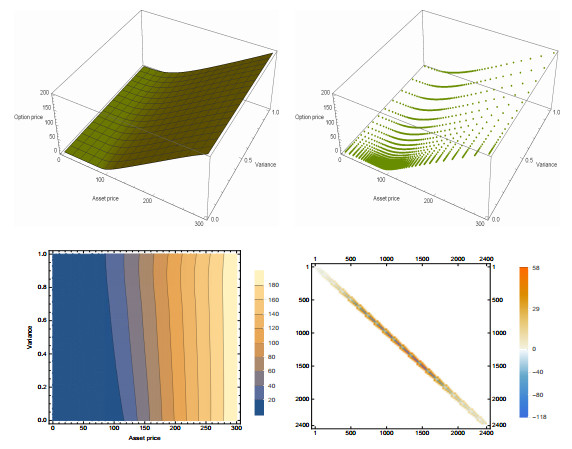

European option valuation under the Bates PIDE in finance: A numerical implementation of the Gaussian scheme

European option valuation under the Bates PIDE in finance: A numerical implementation of the Gaussian scheme

Corporate Finance - International Student Version, 3Ed: ROBERT PARRINO, DAVID KIDWELL, THOMAS BATES, PETER MOLES: 9788126557011: Amazon.com: Books

Fundamentals of Corporate Finance : Parrino, Robert, Kidwell, David S., Bates, Thomas: Amazon.es: Libros

Paper tutorial 4 - Bates at al. (2009): Why Do U.S. Firms Hold So Much More Cash than They Used - Studeersnel

Essentials of Corporate Finance by Parrino, Robert, Kidwell, David S., Bates, Thomas 1st edition (2013) Hardcover: Amazon.com: Books

Fundamentals of Corporate Finance : Parrino, Robert, Kidwell, David S., Bates, Thomas, Gillan, Stuart L.: Amazon.com.au: Books

Geoffrey Swift named Bates Vice President for Finance and Administration and Treasurer | News | Bates College

Fundamentals of Corporate Finance - Parrino, Robert; Kidwell, David S.; Bates, Thomas; Moles, Peter: 9781118961292 - AbeBooks

Fundamentals of Corporate Finance by Thomas Bates, Robert Parrino, Stuart L.... 9781119371403 | eBay